Osprey Total Return

Osprey was the first actively-managed, on-chain portfolio designed to offer returns that that aimed to generate a target return above SOFR for loan providers. This was part of an initiative launched with Maple Finance.

The target portfolio consisted of US Treasuries, highly rated ABS and syndicated loans, with the overwhelming majority being in ABS. The portfolio strategy hinged on three key principles:

Capital preservation

Liquidity

Returns

Capital preservation

In order to achieve capital preservation, 90% of the portfolio comprised of Investment grade (IG) instruments.

This was further delivered by deploying capital into more Senior as well as highly diversified positions in terms of industry, geography and underlying borrower concentration.

A robust set of standard tests, which included but were not limited to Over-Collateralisation tests, Interest Cover tests, Capitalisation test and Diversity score test at the underlying borrower level, was applied before any deployment and during the lifetime of the portfolio to preserve the capital position.

Liquidity

The portfolio composition was designed to ensure that the portfolio met acceptable levels of liquidity.

As well as relying on T+1 liquidity offered by US T-Bills, the global securitisation market has an estimated size of circa $13trn, with a strong secondary market, particularly for AAA and AA rated instruments.

The secondary market for ABS products has proven very resilient, with a high level of trades, even during periods of high volatility and economic downturn.

Returns

With returns ranging from 75bps to 950bps+ within the IG range for the identified ABS. We aimed to achieve robust and sustained returns from the portfolio.

These returns were enhanced by the ability to have direct access to originators and issuers, providing the portfolio manager to pick and choose at source the best deals for the portfolio.

Recommended insights

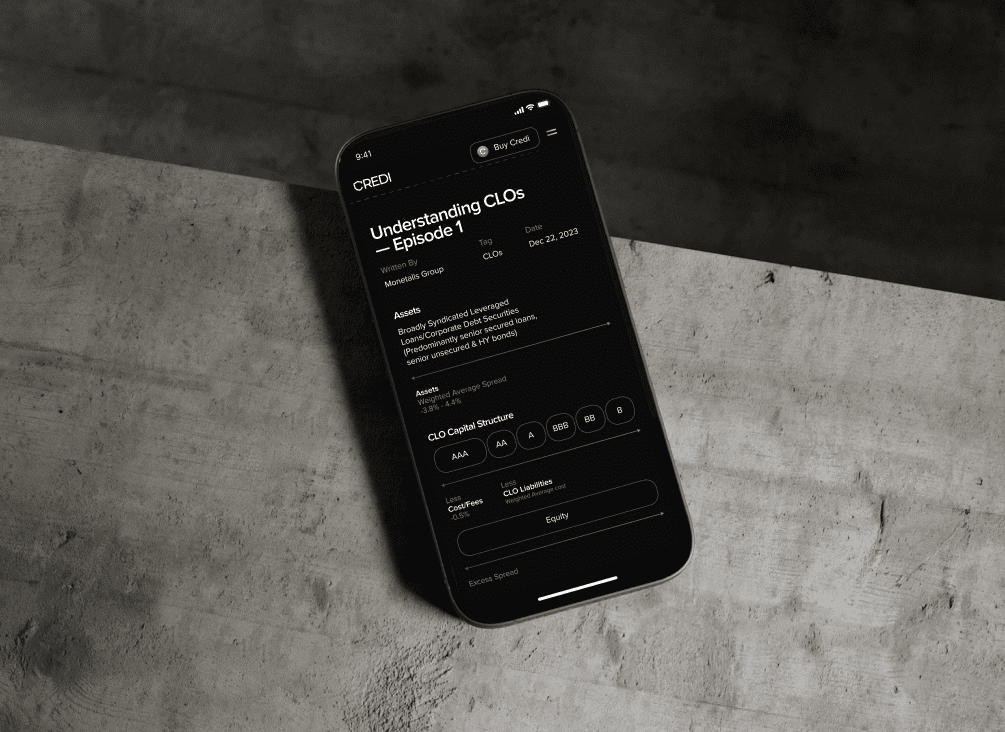

CLOs at a glance

ABS of Corporate Loans: A Collateralised Loan Obligation is a structured credit product built upon a portfolio of leveraged loans (senior secured loans to Private-Equity owned corporates)

Learn More

Understanding CLOs

Welcome to our series of memos on CLOs, to help un-mask some of the mystery behind this high performance credit product. Over this series we aim to cover:

Learn More